OUTLOOK

FY 2015 was a year whereby the PRC real estate

sector displayed very diverse and localised market

sentiments. While 3

rd

and 4

th

tier cities continue to

be burdened by an inventory overhang, land and

property prices in the core cities rose steadily on a

healthy market recovery. Building on our strategy

to focus on core areas within high-growth cities, we

have benefited from the healthy market recovery

and continued our lead as the developer with one

of the highest ASP in the PRC real estate space.

While the Company’s high-quality developments

continue to enjoy significant brand equity in

the PRC, the ability to replenish our prime

landbank at fair cost will be imperative to our

future development. Building on our strategy to

focus on key high-growth cities, we continue to

play an active role in the primary redevelopment

market through our showcase Sino-Singapore

Nanjing Eco Hi-tech Island – a flagship economic

collaboration program developed under the

auspices of the Singapore Jiangsu Cooperation

Council, as well as our Haimen Yangtze Eco Hi-

techCity.We also endeavor to play an active role in

enhancing the cityscape of established cities such

as our redevelopment projects in the Shenzhen

Longgang District. Through these initiatives,

we have established a stable platform to further

facilitate our landbanking requirements.

Looking ahead, we remain positive on the outlook

of the PRC real estate sector. While uncertainties

in the global economies coupled with China’s

on-going economic reforms may lead to some

market volatilites, but continued traction in

China’s urbanisation drive coupled with the

wealth creation effect of the country’s expanding

middle class, will undoubtedly drive demand

for high-quality residential developments.

Capitalising on our track record and comparative

advantages in the development of quality projects,

sizable landbank in prime locations within high-

growth cities in PRC coupled with our healthy

financial position, we are well poised to tap on

the long-term growth prospects of the PRC real

estate sector to generate greater returns for our

stakeholders.

IN APPRECIATION

On behalf of the Board of Directors, I would like to

express our sincere gratitude to our shareholders

for their trust and support. In appreciation of

our loyal shareholders, the Board has proposed

the payment of a first and final dividend of 1.52

Singapore cents (equivalent to 6.90 Renminbi

cents) per ordinary share for FY 2015, amounting

to a dividend payout ratio of approximately

9.2% of FY 2015 profit attributable to owners of

the Company. Looking ahead, we will continue

to build on our proven business strategies and

endeavour to increase shareholder value through

better operational and financial performance.

ZHONG SHENG JIAN

Chairman and CEO

Yanlord

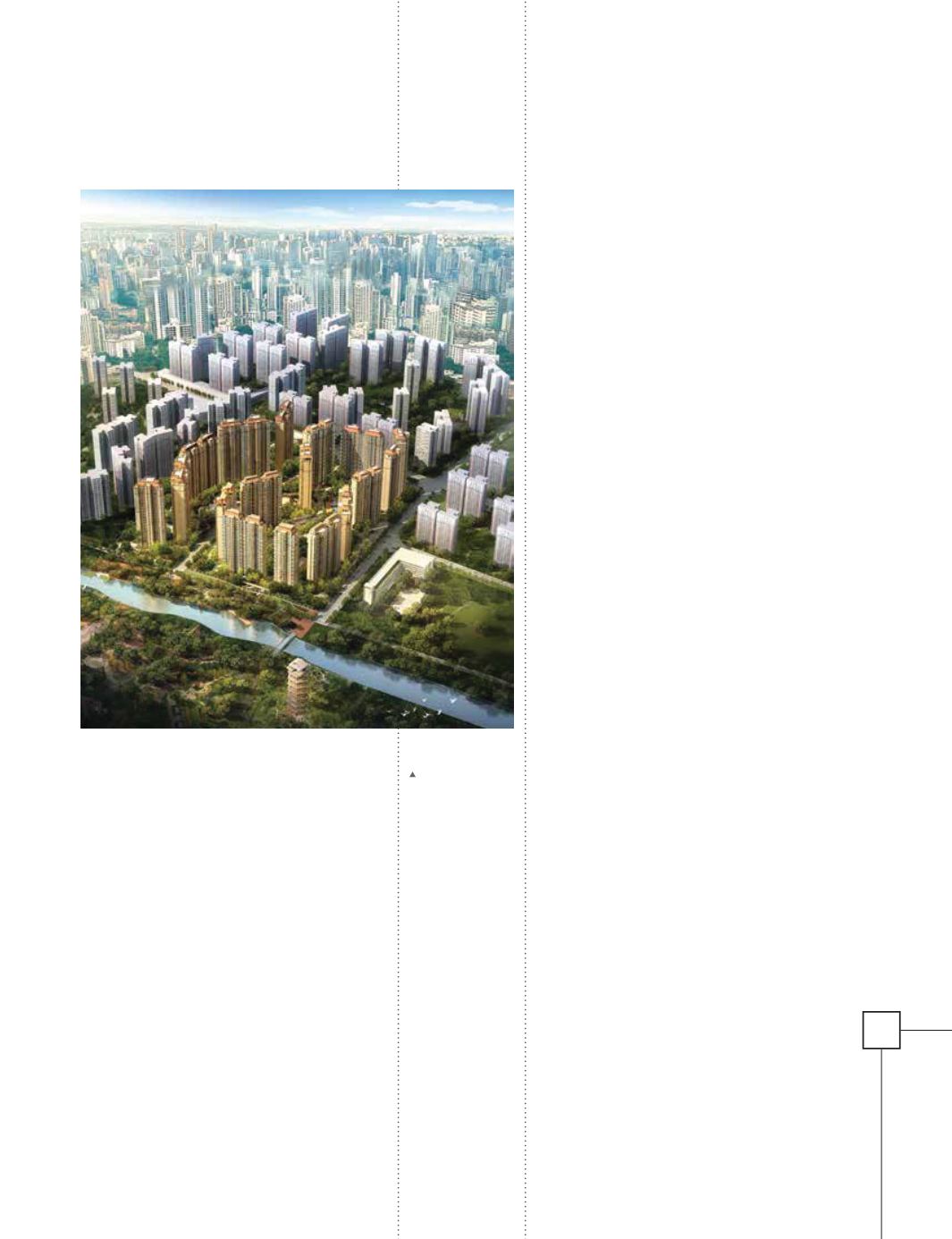

Riverbay, Chengdu

䧭鿪➋䛎忡屎弩

7