Dear Shareholders

It is with great pleasure that I present to you

Yanlord Land Group Limited’s (“Yanlord” and

together with its subsidiaries, the “Group”) annual

report for the financial year ended 31 December

2015 (“FY 2015”).

FY 2015 was an exciting year for the Group

as we mark the start of our 10

th

anniversary of

listing with a record setting 127.0% increase in

pre-sales to RMB28.887 billion in FY 2015 as

compared to FY 2014. This strong growth in pre-

sales was achieved on the back of the recovery

of market sentiments in the 1

st

and 2

nd

tier cities

of the People’s Republic of China (“PRC”) as

well as our strategic direction to enhance asset

churn while maintaining the high-quality of our

developments.

As mentioned in my FY 2014 message, the real

estate sector remains a cornerstone in China’s

economic development. Against the backdrop of

China’s continued urbanisation and progressive

easing of austerity measures, Yanlord, with our

dedicated management team and our healthy

pipeline of project launches in prime locations

within the 1

st

and 2

nd

tier cities of the PRC stands

poised to benefit from the recovery of market

sentiments.

Looking ahead, we remain confident about the

outlook for the PRC real estate sector and I would

like to take this opportunity to share my views

on the sector as well as the Group’s sustainable

growth strategy and future development plans.

DEDICATED TEAM PAVING THE WAY FOR

GREATER MARKET TRACTION

Buoyed by the positive market environment in the

Group’s core markets of Shanghai, Tianjin, Suzhou,

Shenzhen and Nanjing, gross floor area (“GFA”)

delivered rose 39.6% to approximately 590,000

square metre (“sqm”) in FY 2015 as compared to

FY 2014. In tandem with the increased delivery,

recognised revenue for the Group rose 41.3% to

RMB16.581 billion in FY 2015. Underscored by the

Group’s strategic focus on high value developments

within the key areas of high growth 1

st

and 2

nd

tier cities, core profit attributable to owners of

the Company excluding the fair value gain on

investment properties and net foreign exchange

effects leapt 59.0% to RMB1.095 billion in FY

2015 from RMB689 million in FY 2014. Against

the backdrop of this strong core profit growth, the

Group continues to maintain one of the lowest

net debt to equity ratio within the PRC property

sector of 2.9%. Average selling prices (“ASP”) of

our developments grew steadily in FY 2015, in

particular, our projects in Shenzhen witnessed a

greater than 50.0% jump in ASP within a year of

launch on strong buyer demand.

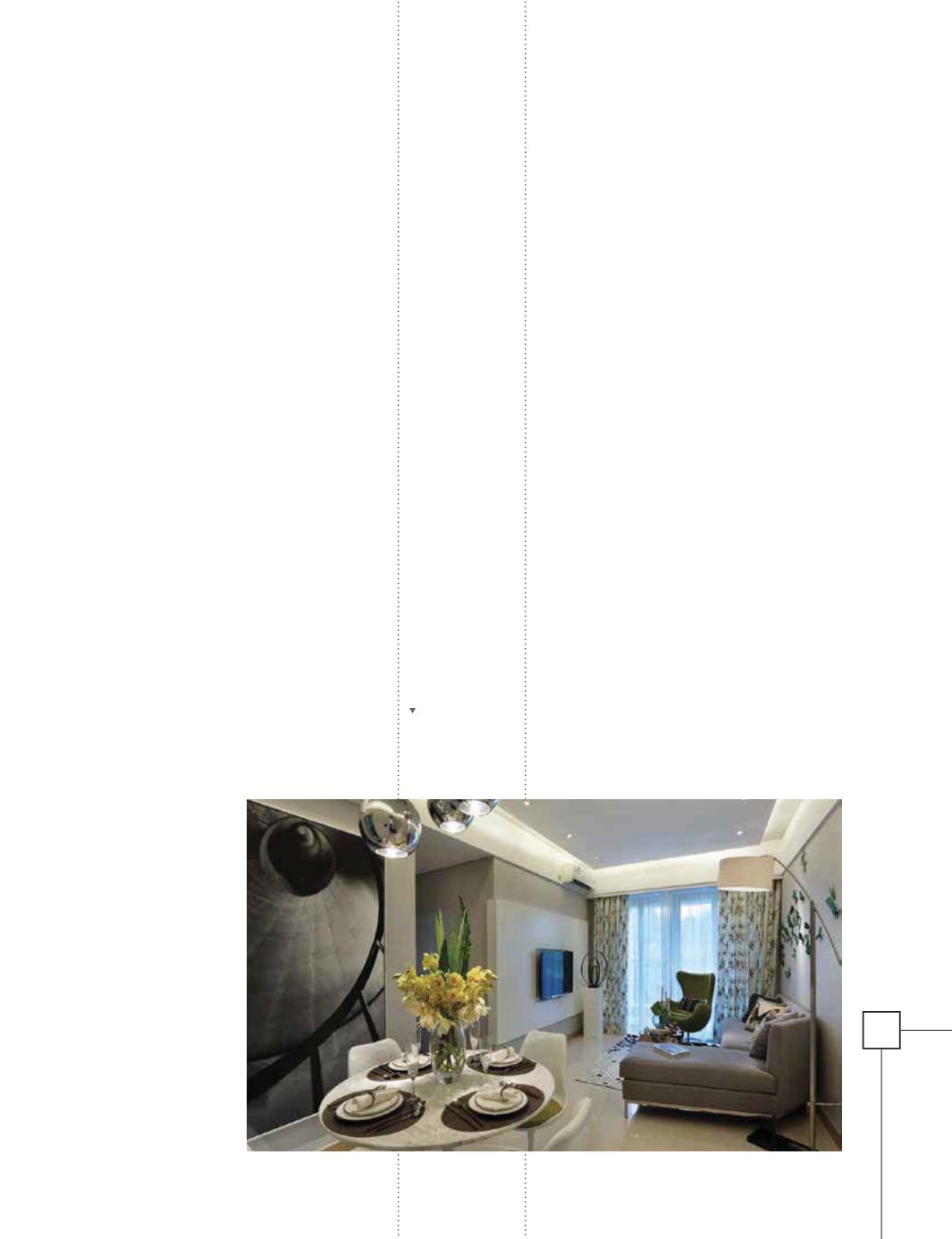

Yanlord Rosemite,

Shenzhen

帿㖕➋䛎䂧㿋繠㖑

蔄㔩

5